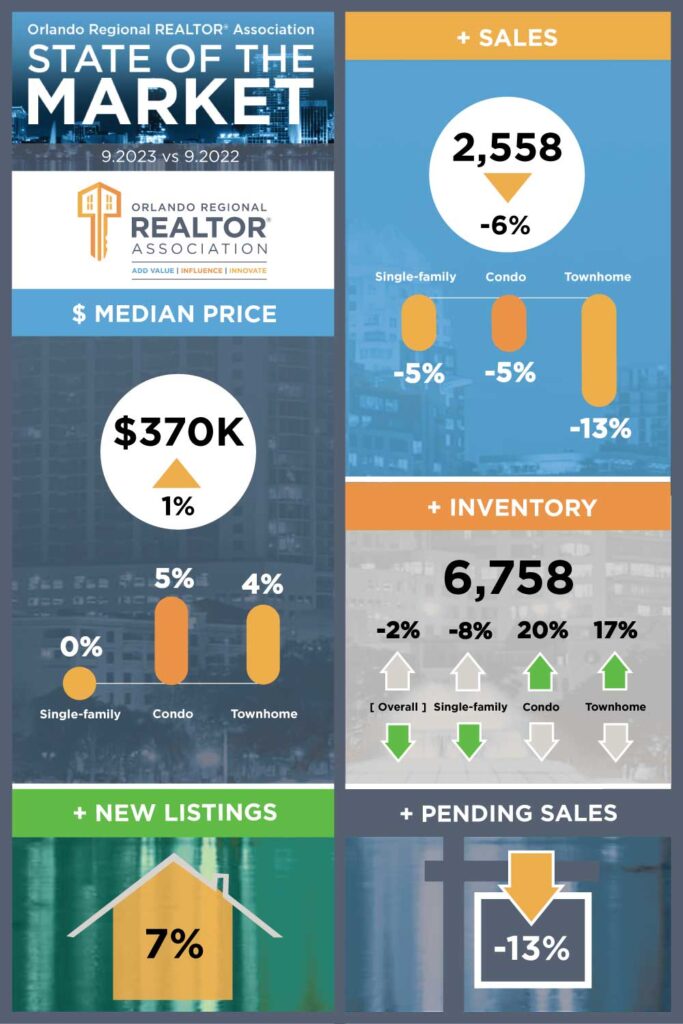

Orlando State of the Market September 2023

October 17th, 2023 by tisnerNew Orlando Regional REALTOR® Association data shows rates reach highest level in over 20 years, contributing to market slowdown this fall.

State of the Market

- September’s interest rate was recorded at 7.3%, up from 6.6% in August. This is the highest interest rate since March 2002.

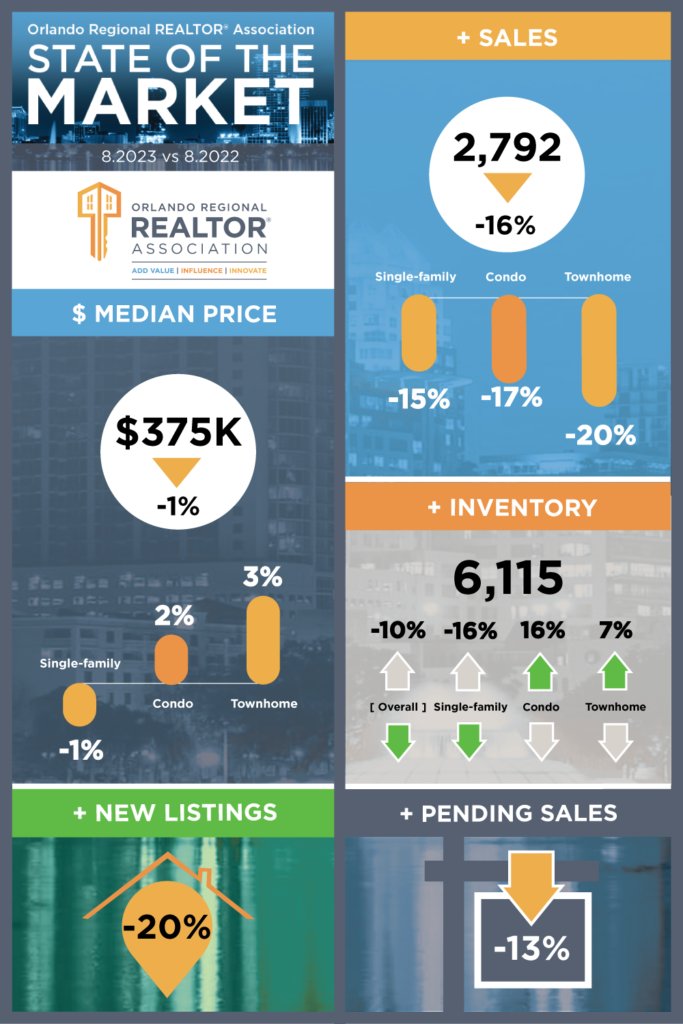

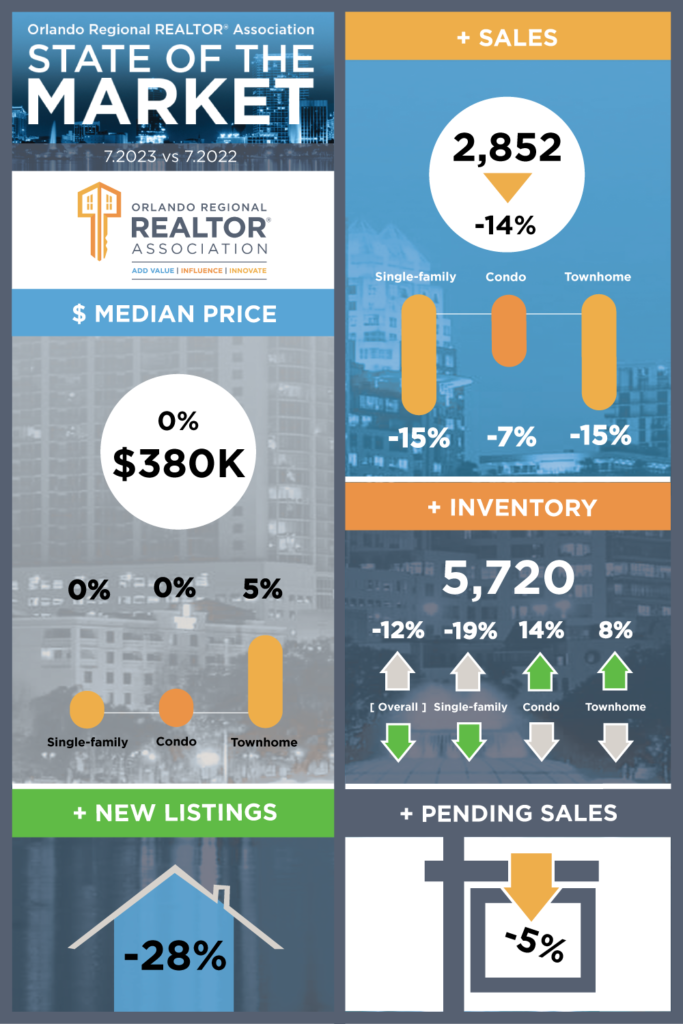

- Inventory for September was recorded at 6,758, up 10.5% from August when inventory was recorded at 6,115. This is the sixth month in a row inventory has risen.

- Overall sales fell 8.4% from August to September. There were 2,558 sales in September, down from 2,792 sales in August. This is the fourth month in a row that home sales have fallen.

- The median home price for September was recorded at $370,000, down from $375,000 in August. This is the third month in a row that median home price has fallen.

- New listings fell 2.1% from August to September, with 3,545 new homes on the market in September, compared to 3,620 in August.

- Homes spent an average of 41 days on the market (DOM) in September – the same as in August. This is 32.3% higher than September 2022 when homes spent an average of 31 days on the market.

- “Rising rates in September contributed to continued rising inventory, falling sales and falling median home price,” said Lisa Hill, Orlando Regional REALTOR® Association President. “Home sales during the fall are typically slower than sales during the spring or summer, and this may be especially prevalent this season with rates reaching their highest level in over 20 years. High interest rates have been the No. 1 factor affecting buyers this year, and it’s evident this challenge will persist.”

Market Snapshot

- Interest rates rose from 6.6% in August to 7.3% in September. This is 15.3% higher than September 2022 when interest rates were 6.3%.

- Pending sales fell 8.9%, with 3,647 in August and 3,322 in September.

- 16 distressed homes (bank-owned properties and short sales) accounted for 0.6% of all home sales in September. That represents a 23.8% decrease from August, when 21 distressed homes sold.

Inventory

- Orlando area inventory increased 10.5% from August to September. Inventory in August was 6,115 and inventory in September was 6,758.

- The supply of homes increased to 2.64 months in September, up 20.6% from 2.19 months in August. A balanced market is six months of supply.

- The number of new listings decreased from August to September by 2.1% – from 3,620 homes to 3,545 homes.

ORRA’s full State of the Market Report for September can be found here.

This representation is based in whole or in part on data supplied by the Orlando Regional REALTOR® Association and the Stellar Multiple Listing Service. Neither the association nor StellarMLS guarantees or is in any way responsible for its accuracy. Data maintained by the association or by StellarMLS does not reflect all real estate activity in the market. Due to late closings, an adjustment is necessary to record those closings posted after our reporting date.

ORRA REALTOR® sales represent sales involving Orlando Regional REALTOR® Association members, who are primarily – but not exclusively – located in Orange and Seminole counties. Note that statistics released each month August be revised in the future as new data is received.

Orlando MSA numbers reflect sales of homes located in Orange, Seminole, Osceola, and Lake counties by members of any REALTOR® association, not just members of ORRA.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.