WASHINGTON (AP) – Maybe it was just too good to be true.

For a few weeks in late January and early February, the U.S. economy seemed to have reached a rare, sweet spot. Inflation was steadily slowing from painful heights. And growth and hiring remained surprisingly sturdy despite ever-higher interest rates imposed by the Federal Reserve.

Perhaps, the thinking went, the Fed’s inflation fighters were managing to nail a notoriously difficult “soft landing”: A scenario in which borrowing and spending slow just enough to tame inflation without tipping the world’s biggest economy into a recession.

“We were looking at landings that were pillow-soft,” recalled Diane Swonk, chief economist at the accounting giant KPMG. “There was a bit of glee about that.”

The financial markets roared their approval in the first six weeks of 2023, with stock prices surging on expectations that the Fed might soon pause and eventually reverse the series of aggressive rate hikes it began nearly a year ago.

Then something went wrong.

It began on Valentine’s Day. The government said its closely watched consumer price index had surged 0.5% from December to January – five times the increase from November to December.

Over the next week and a half, two more government releases told essentially the same story: The Fed’s fight to curb inflation wasn’t even close to being won.

That realization brought a related worry: If high inflation was even stickier than we thought, then the Fed would likely keep raising rates – and keep them high – longer than was assumed. Those ever-higher borrowing rates would make it more probable that a recession, with layoffs and business failures, might occur.

Fed Chair Jerome Powell warned Congress Tuesday that the central bank will have to raise interest rates even higher than its previously signaled if inflation keeps running hot.

“It’s heartbreaking,” Swonk said. “This has put the Fed back in defensive mode, and they’re going to have to harden their resolve on rate hikes.”

Unsurprisingly, the stock market has recoiled at the prospect.

Here’s a closer look at the economy’s vital signs at a perplexing time of high interest rates, still-punishing inflation and surprisingly strong economic gains.

Inflation

Consumer inflation, not much of a problem, on average, since the early 1980s, started picking up in the spring of 2021 as the economy roared out of recession and Americans spent freely again. At first, Fed Chair Jerome Powell and some economists dismissed the resurgent price spikes as likely a temporary problem that would resolve itself once clogged supply chains had returned to normal.

But the supply bottlenecks lasted longer than expected, and so did high inflation. Worse, Russia’s invasion of Ukraine a year ago sent energy and food prices rocketing. By June 2022, consumer prices were 9.1% higher than they’d been a year earlier – the hottest year-over-year inflation in more than four decades.

By then, the Fed had begun, belatedly, to respond. It has raised its benchmark rate eight times since March 2022 in its most aggressive credit tightening since the early 1980s.

In response, consumer inflation edged down from its mid-2022 peak. It posted milder year-over-year increases for seven straight months as supply chains unclogged and higher borrowing costs worked their way through the economy, putting a brake on overspending.

Financial markets appeared ready to declare the inflation dragon all but slain.

Then came January’s unexpectedly hot consumer inflation data. Two days later, the government reported that wholesale prices had jumped 0.7% from December to January, nearly twice what forecasters had expected.

Next came bad news from the inflation gauge the Fed watches most closely: The government’s personal consumption expenditures price index. It accelerated 0.6% from December to January, far above the 0.2% November-to-December uptick. On a year-over-year basis, prices rose 5.4%, up slightly from the annual increase in December and well above the Fed’s 2% inflation target.

The PCE report “adds to the difficult if not impossible task facing the Fed in terms of getting inflation back to its 2% target without driving the economy into a ditch,” said Joshua Shapiro, chief U.S. economist at the Maria Fiorini Ramirez Inc. consultancy.

One concern is that this time, inflation may prove harder to slow than it was initially. Households have increasingly shifted their spending away from physical goods like patio furniture and appliances to experiences like traveling, restaurant meals and entertainment events. Inflationary pressures, too, have shifted from goods toward services, where price acceleration can be harder to tame.

In part, that’s because chronic labor shortages at stores, restaurants, hotels and other service-sector industries have led many employers in those industries to keep raising pay to attract or retain workers. Those employers, in turn, have generally raised their prices to make up for their higher labor costs, thereby fueling inflation.

Some economists expect the Fed to raise its benchmark rate by a substantial half-percentage point when it next meets March 21-22, after having announced only a quarter-point hike when it met Jan. 31-Feb. 1.

Housing

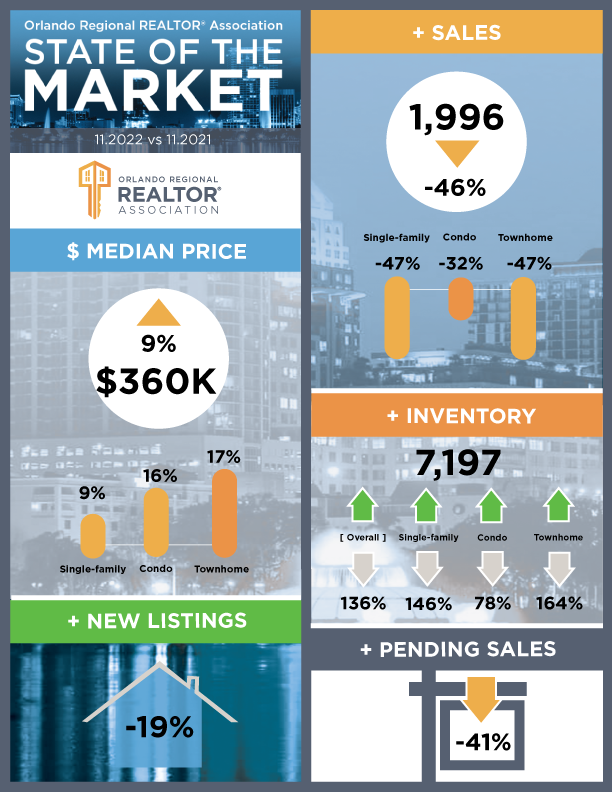

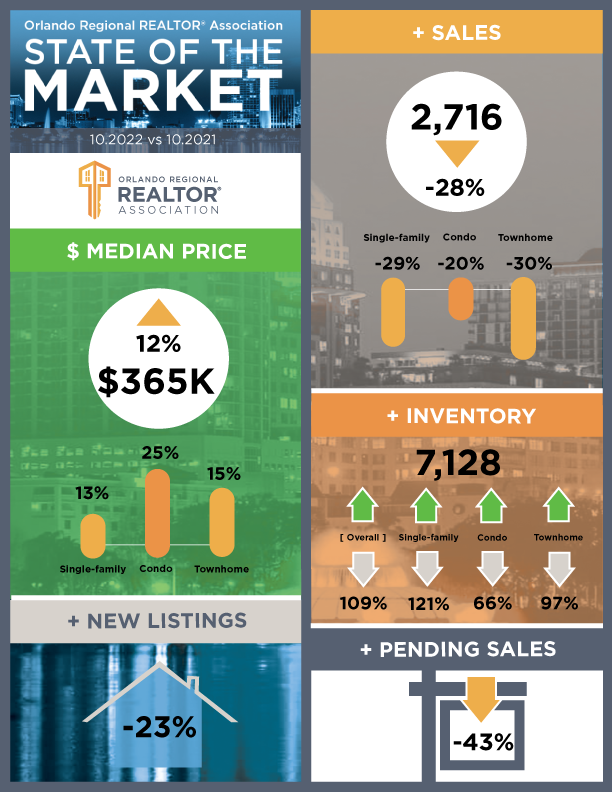

The Fed’s rate hikes, which so far have had only a limited effect on the overall economy, have walloped one industry: Housing.

Residential real estate depends on the willingness of people to borrow for what’s typically the costliest purchase of their lives. As the Fed continually jacked up interest rates last year, the average rate on a 30-year fixed mortgage topped 7% last fall – more than double where it began 2022 – before dropping back slightly.

The damage has been severe. Sales of existing homes have dropped for a record 12 straight months, according to the National Association of Realtors®. And the government’s GDP report showed that investment in housing plunged at an annual rate of nearly 26% from October through December after having tumbled 18% from April through June and 27% from July through September.

The overall economy

The flipside of the disquieting inflation news is good news on the state of the economy – or what would be considered good news in normal times. Even burdened by rising borrowing rates, the economy has proved stronger and sturdier than most forecasters had imagined.

“This economy today looks very different from where we thought it was in mid-January,” said Peter Hooper, an economist at Deutsche Bank. “Before, we thought that things were slowing down, the labor market was softening, wage and price inflation was coming down.”

With inflation pressures still persistent, Hooper said, “there’s this growing expectation that the Fed has clearly more work to do.”

The economy regained its footing last summer after enduring an anemic first half of 2022. The nation’s gross domestic product – its total output of goods and services – contracted from January through March last year and again from April through June.

Though one informal definition of a recession is two straight quarters of negative growth, most economists set aside such concerns this time. They noted that the economy had shrunk in early 2022 because of factors unrelated to its underlying health: Leaner business inventories and a surge in imports, which widened the U.S. trade deficit.

GDP quickly regained momentum: It grew at a solid 3.2% annual rate from July through September and a 2.7% rate from October through December. Steady consumer spending contributed heavily to the growth.

Economists still foresee a recession sometime this year – they were always skeptical of a soft landing – but now see it coming later than they’d expected. A survey of 48 forecasters issued last week by the National Association for Business Economics found that only a quarter of the respondents think a recession will have started by the end of March, down from half who had predicted so in December.

Jobs

The remarkable strength of the American job market has defied expectations throughout the economic tumult of the COVID years. 2021 and 2022 were the two best years for hiring in U.S. government records dating to 1940.

Job creation was expected to slow this year. Not so far. In January, employers added a blistering 517,000 jobs, far surpassing December’s 260,000 gain. They likely added nearly 208,000 more in February, according to a survey of forecasters by the data firm FactSet. The Labor Department releases last month’s job numbers on Friday.

What’s more, American workers as a whole are enjoying nearly unheard-of job security despite some high-profile layoffs in technology and a few other sectors. The government’s count of monthly dismissals and layoffs sank below 1.5 million for the first time in 2021 and has stayed there since.

In January, the unemployment rate reached 3.4%, its lowest level since 1969. There are now about two job openings, on average, for each unemployed American.

But a robust job market also puts upward pressure on wages – and therefore on prices. Which means further inflation.

“The kind of wage gains we’re seeing and the kind of tightness in the labor market is consistent with 3.5% to 4% inflation, not 2% or 3%,” KPMG’s Swonk said. “That’s the hard reality of where we are.”

Consumers

Their jobs secure, their bank accounts still bolstered by pandemic-era savings, Americans have continued to spend, shrugging off higher interest rates and prices.

In January, retail sales rose at their fastest pace in nearly two years, rebounding from a tepid holiday shopping season. Even after accounting for inflation, consumers spent their after-tax dollars at the fastest pace since March 2021. Consumer spending on services, ranging from health care to dinners out to airline tickets last year accounted for 95% of the economy’s growth.

Mark Zandi, chief economist at Moody’s Analytics, estimates that consumers still have $1.5 trillion in “excess savings” – above what they’d have socked away if the pandemic hadn’t hit – from government aid and from cutting back while stuck at home at the peak of the pandemic.

Still, inflation continues to cause hardships for millions of households. Adjusted for inflation, average hourly earnings have fallen for 22 straight months, government data shows. Many low- and middle-income families are turning to credit cards to sustain their spending.

Copyright 2023 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission. AP Economics Writer Christopher Rugaber contributed to this report.

By: www.floridarealtors.org, Paul Wiseman

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.