New Year’s Resolutions for Homeowners

January 2nd, 2024 by tisner

New year, new you, right? Oh, we all seem to resolve to eat healthier, lose weight, kick dirty habits and all kinds of other things, but by the end of February, we find ourselves just trying to remember what our resolutions were, much less actually sticking to them! Homeownership is the same way–we start out with big ideas of what we’ll be doing to maintain it, then life gets in the way, and we fall short. Get started with this guide:

- Having an energy audit performed on your house will help you save not only energy but money, too.

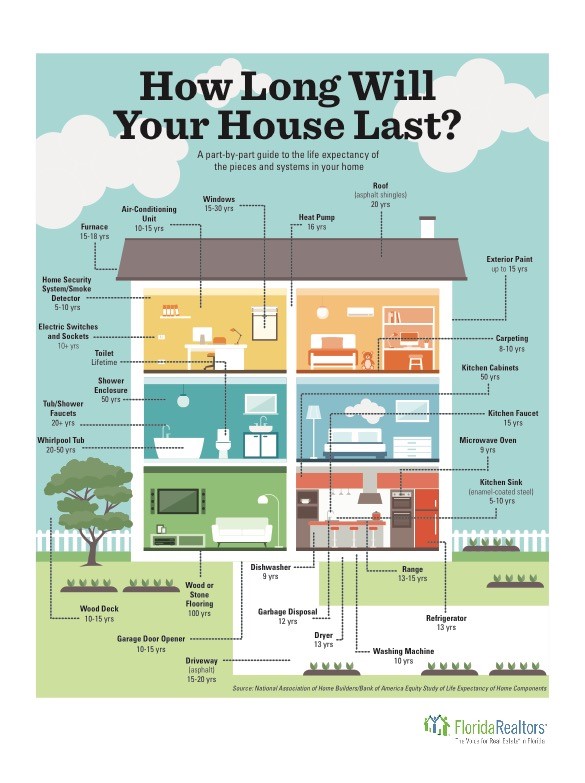

- Your dryer’s lint trap should be cleaned routinely after each load, but your vent and vent tubing should be cleaned at least annually. Removing as much lint as you can helps dry your laundry faster and reduce the risk of fire.

- Home security systems aren’t foolproof against hackers, and neither are smart home accessories. Change passwords frequently, and don’t reuse passwords. To make it even more difficult to hack, use two-factor authentication.

- The Family Handyman has several tips for keeping the yard and yard tools in tip-top shape.

- Resolve to cut the clutter in your house. While the temps are cool, and you’re spending more time inside anyway, take one room in your home per week to clean out and clean up.

- Repair the little things that you overlook because they’re not necessarily a safety issue: doorknobs that aren’t working, dripping faucets, or squeaky floors. Fix now to save you from something bigger happening and costing you more later.

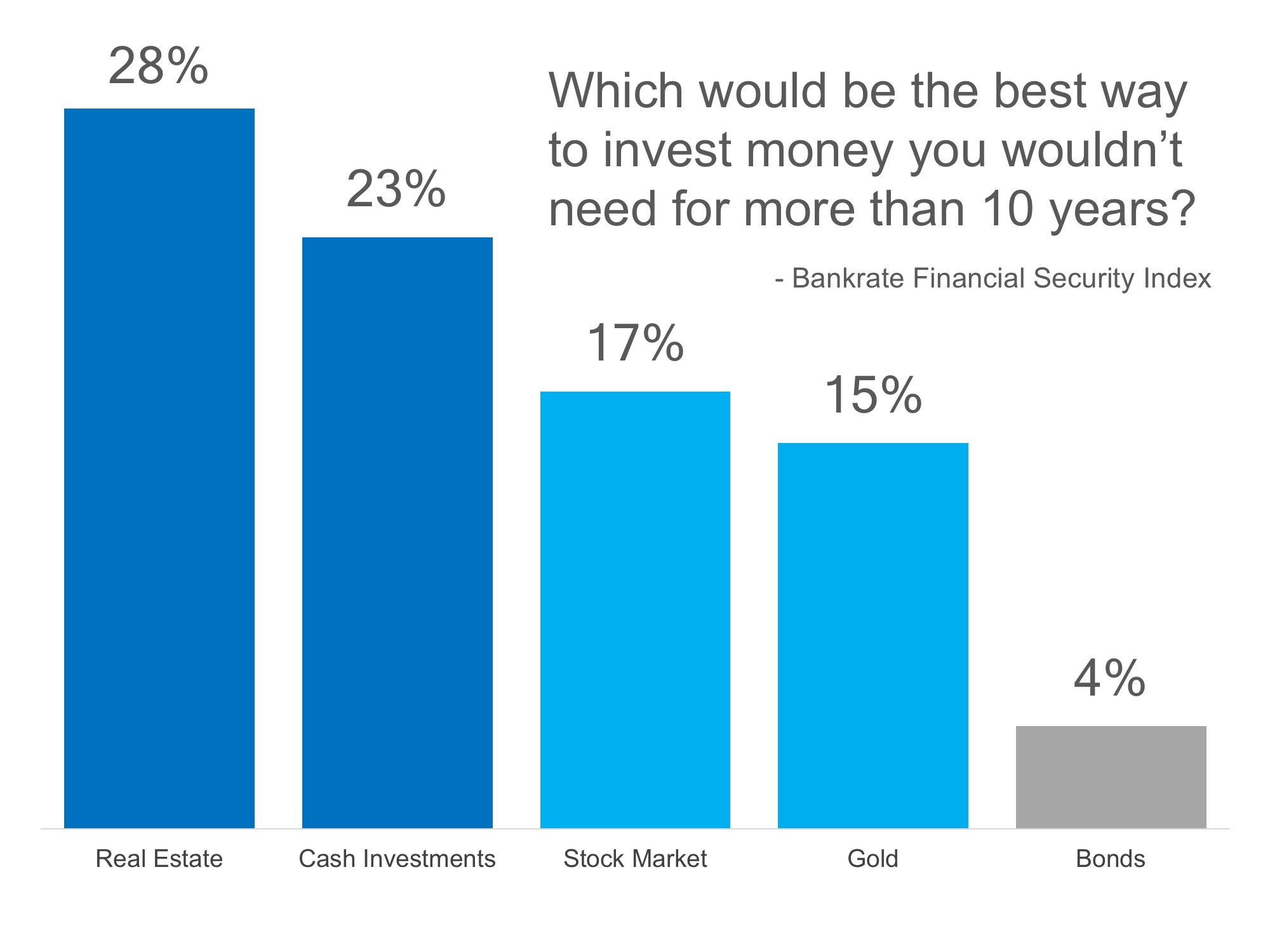

- Get your personal finances in order! Commit to saving money, not only in the literal sense, but get the best rates on insurance, or consider refinancing your mortgage. NerdWallet has some great tips for building equity in your home.

- Print out this free home checklist, and you won’t miss a thing each season!

Find a good balance of taking care of home and taking care of you and your family. Don’t spend every spare minute maintaining your home. Some projects can combine family and work time, like a big cleaning job, or yard work. As important as it is to keep up your home, it’s important to keep up with family as well.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

![The Cost of Renting vs. Buying in the US [INFOGRAPHIC] | Keeping Current Matters](https://d3sj2vq3d2xms.cloudfront.net/wp-content/uploads/2017/06/20140038/20170623-Rent-vs.-Buy-KCM.jpg)