Orlando State of the Market July 2024

August 16th, 2024 by tisnerNew Orlando Regional REALTOR® Association data shows market continues to stabilize for homebuyers as inventory increases for seventh month in a row.

State of the Market

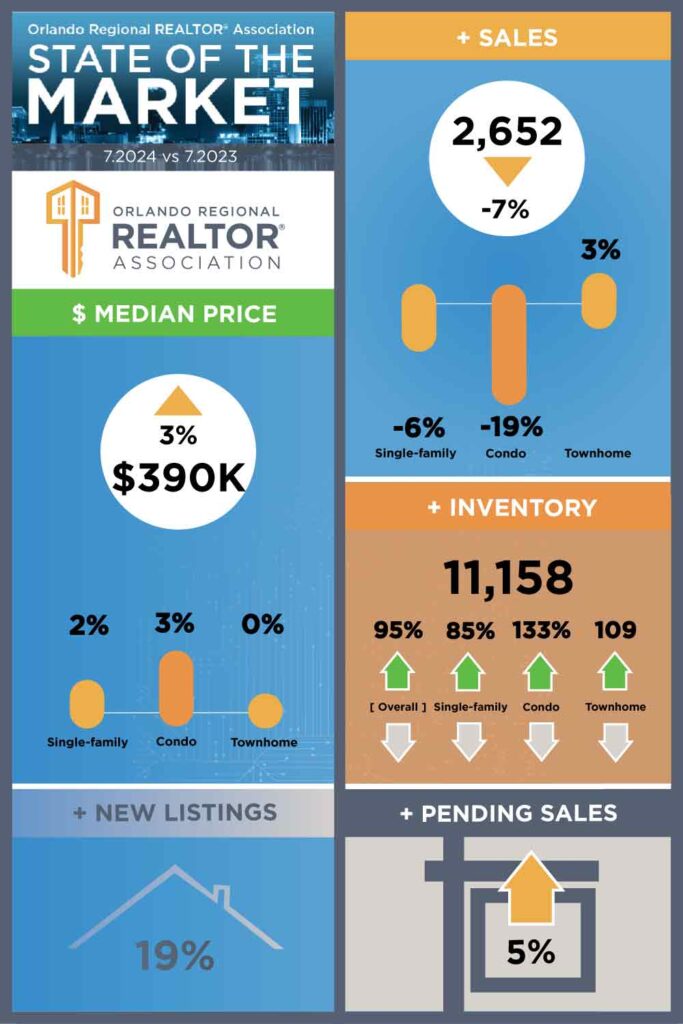

- July’s interest rate was recorded at 6.6%, down from 6.7% in June.

- In ORRA’s new survey of Orlando REALTORS, 52% of respondents cited interest rates as the top challenge for buyers, causing some buyers to wait out purchasing homes right now or look at lower price points.

- The median home price for July was recorded at $390,000, down from $395,000 in June. June was the highest monthly median home price on record in the Orlando area.

- Home prices were cited as the second biggest issue facing buyers in ORRA’s new survey.

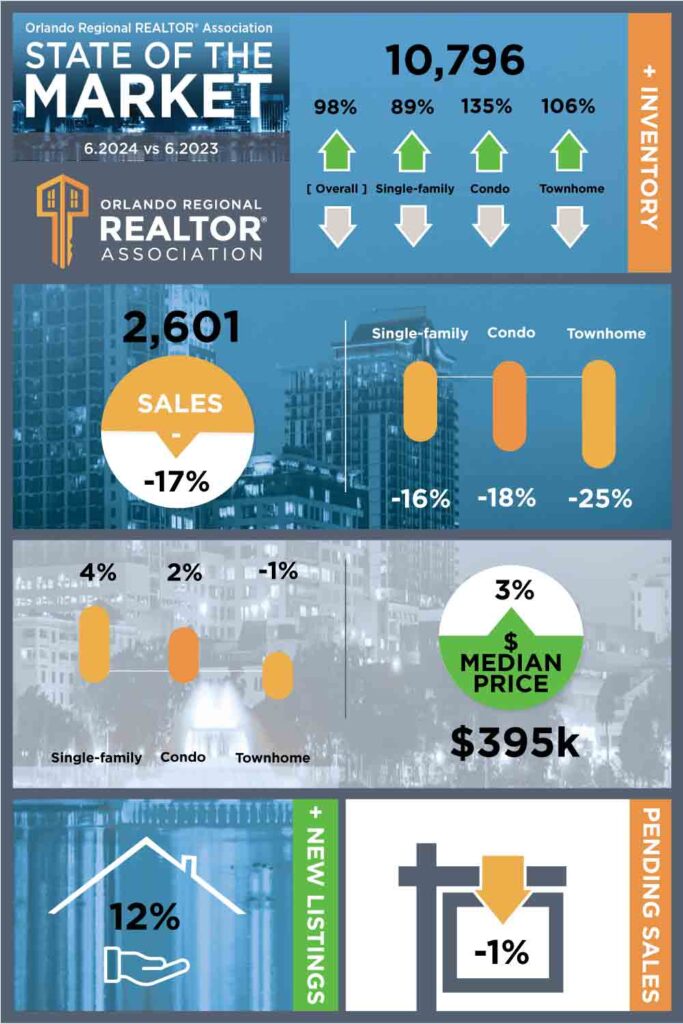

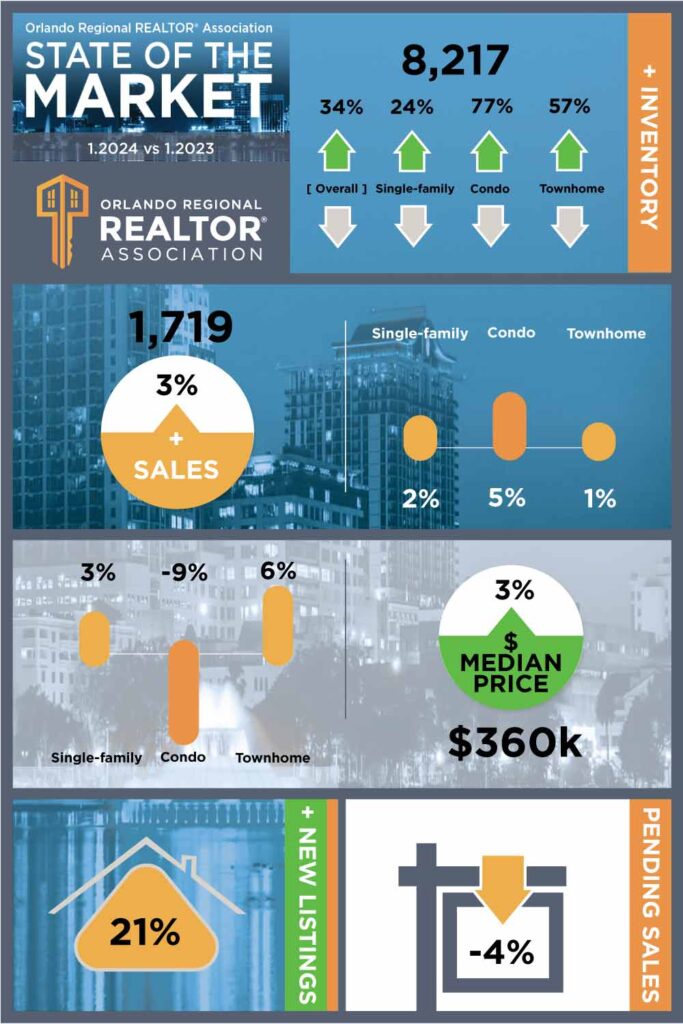

- Inventory for July was recorded at 11,158, up 3.4% from June when inventory was recorded at 10,796. This is the seventh month in a row inventory has risen. The last time inventory was this high was November 2015.

- Inventory in July 2024 was 95.1% higher than in July 2023.

- Overall sales rose 2.0% from June to July. There were 2,652 sales in July, up from 2,601 sales in June.

- Pending sales rose by 1.5%, with 3,940 in June and 3,999 in July.

- New listings fell 1.8% from June to July, with 4,067 new homes on the market in July, compared to 4,143 in June.

- Homes spent an average of 55 days on the market (DOM) in July – up from 54 in June. This is 41.0% higher than July 2023 when homes spent an average of 39 days on the market.

- 72% of survey respondents reported that most homes are moving from sale to pending in 21+ days, up significantly from last year.

- “July represented another strong month in the housing market as many families worked to squeeze in their moves before the start of the new school year. We continued to see an increase in inventory and sales as the Orlando housing market continues to stabilize,” said Rose Kemp, Orlando Regional REALTOR® Association President. “Interest rates are still holding steady in the mid-upper 6.0% range. The current market conditions offer more options for buyers along with new potential negotiating opportunities. Realtors are key to the success of a buyer and seller transaction.”

Market Snapshot

- Interest rates fell from 6.7% in June to 6.6% in July.

- Pending sales rose 1.5%, with 3,940 in June and 3,999 in July.

- 25 distressed homes (bank-owned properties and short sales) accounted for 0.9% of all home sales in July. This is the same number of distressed homes that sold in June.

Inventory

- Orlando area inventory rose 3.4% from June to July. Inventory in June was 10,796, and inventory in July was 11,158.

- The supply of homes rose to 4.21 months in July, up 1.4% from 4.15 months in June. A balanced market is six months of supply.

- The number of new listings decreased from June to July by 1.8% – from 4,143 homes to 4,067 homes.

You can find ORRA’s full State of the Market Report for May here.

This representation is based in whole or in part on data supplied by the Orlando Regional REALTOR® Association and the Stellar Multiple Listing Service. Neither the association nor StellarMLS guarantees or is in any way responsible for its accuracy. Data maintained by the association or by StellarMLS does not reflect all real estate activity in the market. Due to late closings, an adjustment is necessary to record those closings posted after our reporting date.

ORRA REALTOR® sales represent sales involving Orlando Regional REALTOR® Association members, who are primarily – but not exclusively – located in Orange and Seminole counties. Note that statistics released each month may be revised in the future as new data is received.

Orlando MSA numbers reflect sales of homes located in Orange, Seminole, Osceola, and Lake counties by members of any REALTOR® association, not just members of ORRA.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.