Historical Perspective for Orlando, FL

February 23rd, 2018 by tisnerIn 1968, mortgage rates were 8.5%. The next year, rates went down to 7%. Homeowners could buy a 15-20% larger home for the same payments if they could find someone to assume their mortgage.

FHA and VA mortgages were very popular in certain price ranges and they allowed anyone to assume the mortgage regardless of the credit. If you could find a person to take over your note, you were free to qualify for another mortgage.

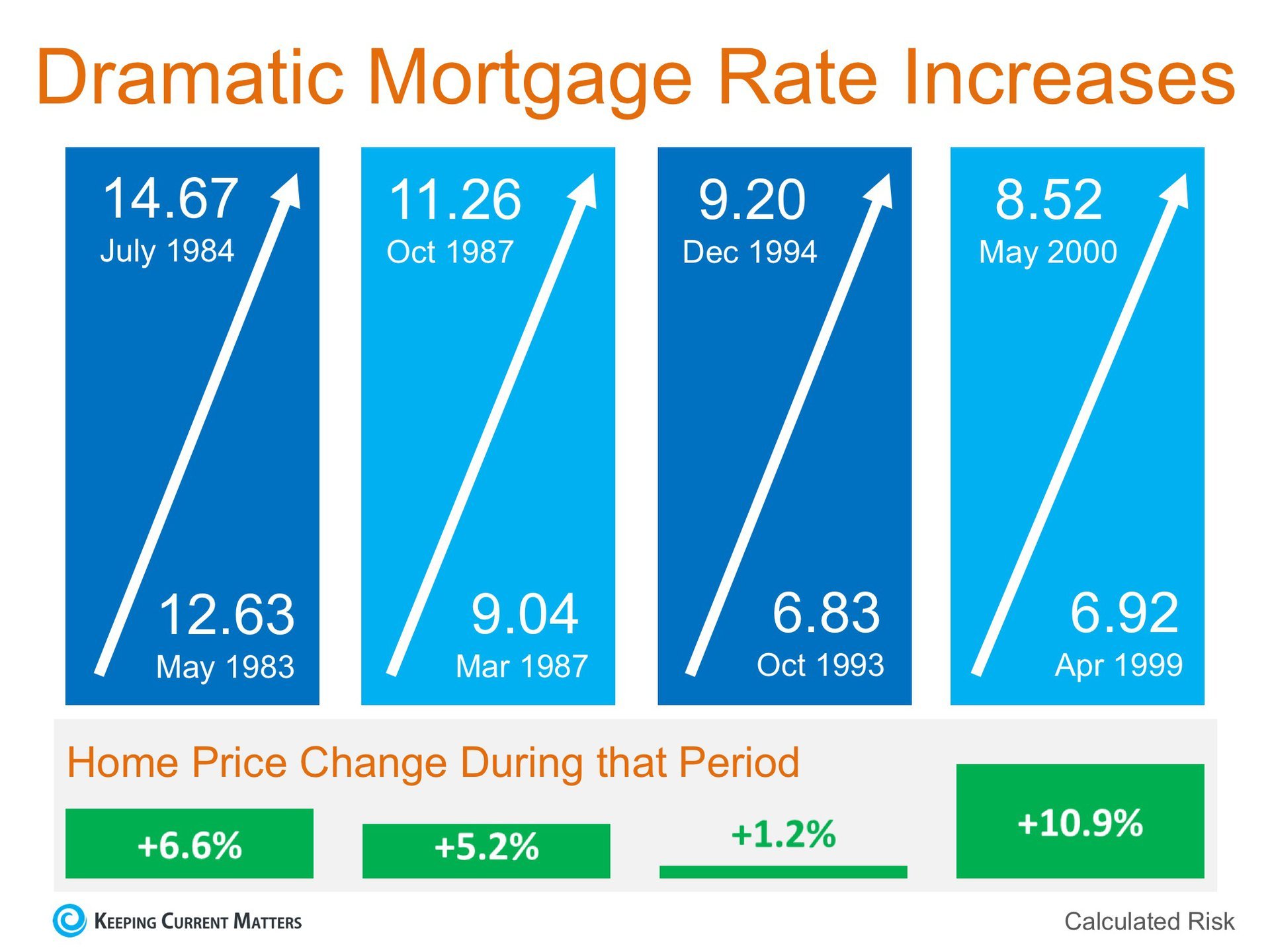

In October 1981, mortgage rates reached 18.63%. A $250,000 mortgage had a monthly principal and interest payment of $3,896.46. As astronomical as that rate sounds, people were still buying homes and were good investments.

Four years later, they were still over 12%. The monthly payment was $2,571.53. Believe it or not, people were excited to be paying only 2/3 what they had to pay a few years earlier.

Fast forward to late 1991 when the rates went below 9% and that same payment was to $2,015.16. At the turn of the 21st century, rates were 8.15% and that made the payment $1,860.62. Not much change in rates during that decade.

If we look around the housing bubble, late 2008, the rates were 6.04% and the payment was $1,505.31. By 2009, mortgage rates had fallen below 5%. The lowest mortgage rate was 3.31% on November 2012 with a payment of $1,096.27.

Rates fluctuated for the next few years until now, and most of the experts are expecting them to be above 5% by the end of 2018. Rates have increased each week for the last six weeks to 4.38% with payments of $1,240.12.

The average mortgage rate for the past 47 years is a little over 8%. The real estate and mortgage markets are cyclical. Rates have been historically low for a long period but will probably continue to rise. Most buyers don’t pay cash and mortgages enable them to purchase now. Based on history, even 8% would be an excellent rate. Until it reaches that point again, everything lower is a bargain.

By: PatZaby.com

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

![Do You Know the Impact Your Interest Rate Makes? [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/08/20150805-Cost-of-Interest-KCM.jpg)