Orlando State of the Market September 2022

October 27th, 2022 by tisnerOrlando Area Residential Real Estate Snapshot for September-2022

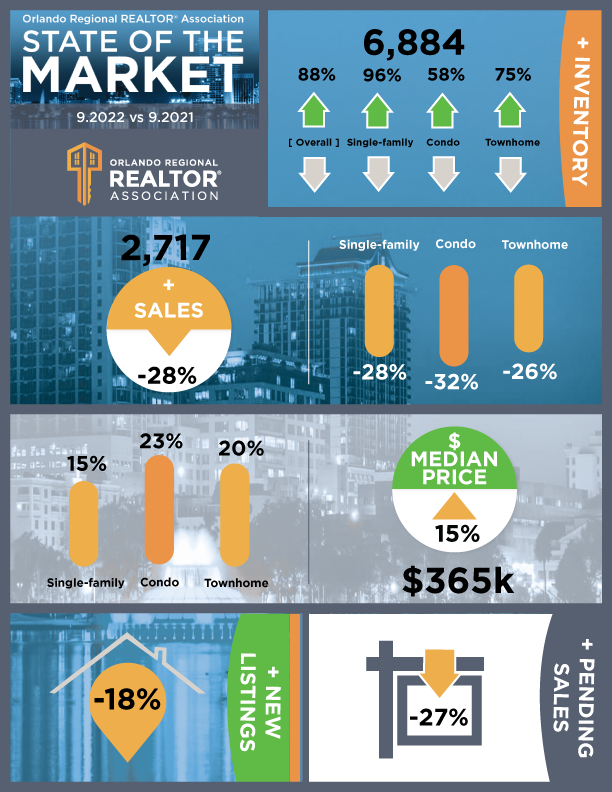

New Orlando Regional REALTOR® Association data shows interest rates surge as home sales see biggest drop since January 2022

State of the Market

- September’s interest rate was recorded at 6.3%, a 19.5% increase from August when the interest rate was 5.3%.

- Overall sales in September dropped by 18.3% for a total of 2,717 sales compared to 3,324 sales in August.

- Overall sales dropped 28.3% in September 2022 compared to September of last year.

- The median home price for September 2022 was recorded at $365,000, a decrease of 3.4% compared to August’s median home price, $377,750. This is the third month in a row that the median home price has fallen.

- Inventory rose 1.8% in September, from 6,762 to 6,884. This is the fifth straight month of inventory increases.

- Homes spent an average of 31 days on the market in September, jumping 14.8% from August when the average was 27 days.

- New listings decreased by 27.1% from August to September, with 3,318 new homes on the market in September.

- “We are starting to feel the impacts of rising interest rates on the Orlando housing market as they have more than doubled over the past 12 months,” said Tansey Soderstrom, Orlando Regional REALTOR® Association President. “Rising interest rates are causing buyers to be more cautious, resulting in fewer Orlando home sales for the month of September. This cooling off in sales does have an upside for buyers, as they now have the luxury of being more patient when looking for a home.”

Market Snapshot

- Interest rates increased as the average interest rate for September was recorded at 6.3%. This is 120.9% higher than September 2021 when interest rates were 2.9%.

- Pending sales decreased by 8% from August to September for a total of 3,838 pending sales.

- 12 distressed homes (bank-owned properties and short sales) accounted for 0.4% of all home sales in September. That represents a 100% increase from August, when 6 distressed homes sold.

Inventory

- Orlando area inventory increased by 1.8% from August to September from 6,762 homes to 6,884 homes. Inventory in September 2022 was 87.9% higher than in September 2021, when it was recorded at 3,664 homes.

- The supply of homes increased to 2.53 months in September. This is the second month since June 2020 with over two months of supply. A balanced market is six months of supply.

- The number of new listings decreased in September from August by 27.1% down to 3,318 homes.

ORRA’s full State of the Market Report for September can be found here.

Access Teri’s one-stop Orlando FL home search website.Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: www.orlandorealtors.org