August 13th, 2019 by tisner

The loss of a job, divorce, a medical emergency or death of a family member can put homeowners in a financial bind. You worked hard to buy your house and make it your family’s home. Don’t let it get to the point of having the bank begin foreclosure proceedings! Here are some tips to help you save your home:

- First and foremost: call the bank before you begin missing payments! If you have equity in your home, this is especially important. Once payments are late, or the lender has filed a notice of default, they will be reluctant or unable to work with you.

- Several agencies offer free credit counseling and can direct you to someone who can assist you with getting those finances in order. The HUD website can put you in touch with a local counselor, or find helpful foreclosure information through the National Foundation for Credit Counseling®.

- Keeping your mortgage payments current is more important than paying credit card bills! Sure, late credit card payments will affect your credit score, but a foreclosure will do far more damage to your rating. Once you get caught up with the house payments, pay off the credit cards as soon as possible.

- Do you have any assets you can sell? Letting go of expensive items that you’re not really taking the time to enjoy–a boat, for instance–can certainly cut monthly expenses, and any proceeds can go to your loan.

- In case you’ve already gotten behind, open every piece of mail that comes from your lender. Many times, they’ll offer options as soon as the first payment is overdue, because they don’t want to foreclose on your loan as much as you don’t want to go into foreclosure.

- Resist any “quick-fix” offers you see on the internet, television commercials and junk mail, or even from so-called investors. These “rescue mortgages” could be a scam and will cost you your home faster than a foreclosure can take place.

- If you see that you can simply no longer afford your home, get advice from an attorney whose specialty is foreclosure, as most will do a one-time consult at no cost. You may also contact Legal Aid for a pro bono lawyer if you can’t afford it.

Don’t be embarrassed about reaching out to your mortgage company and letting them know you’re going through a rough patch. Being proactive before the installments become overdue will allow more options to be available. Your house is your most important investment, and its home. Do what you have to in order to keep it.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Photo credit: debt.org

Tags: foreclosure, home loans, homeowners, mortgage payments, mortgages, orlando avenue top team, Teri Isner, Tips for Avoiding Foreclosure

Posted in Financing, Home Tips from Teri | No Comments »

April 13th, 2018 by tisner

“How long do we have to wait to qualify for another mortgage” is the question concerning people who’ve had a foreclosure, short sale or bankruptcy. The loan types for the new loan will differ in amounts of time to heal credit scores based on the event.

The following chart is meant to be a general guide for how long a person might have to wait. During this waiting period, it’s important that the person be current on all payments and maintains a history of good credit.

A recommended lender can give you specific information regarding your individual situation and can make suggestions that will improve your ability to qualify for a mortgage. This process should be started before looking at homes because of the time constraints listed here can vary based on current requirements and possible extenuating circumstances of your case.

We want to be your personal source of real estate information and we’re committed to helping from purchase to sale and all the years in between. Call us at (407) 467-5155 for lender recommendations.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

By: PAtZaby.com

Tags: bankruptcy, credit scores, Distressed Sale, foreclosure, home loans, homebuyers, mortgage, orlando avenue top team, short sale, Teri Isner

Posted in Financing, Orlando Buyers | No Comments »

December 6th, 2011 by tisner

There were 10,317 Orlando FL foreclosure homes in October, 2011, according to RealtyTrac.com. 1 in every 1,961 housing units received a foreclosure filing. The average sales price of an Orlando home was $121,127 and the average sales price of a foreclosure home was $102,742, a $96,284 savings.

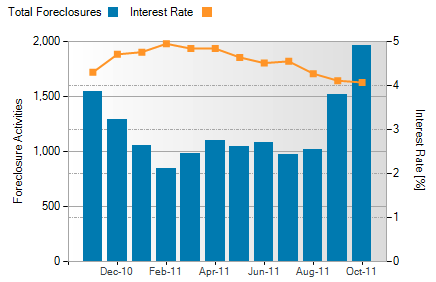

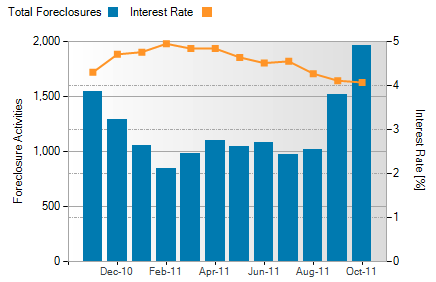

Orlando FL Foreclosure Activity and 30 Year Interest Rate

The interest rate on a 30 year mortgage was 4.07% in October and there were 1,961 new foreclosures.

Foreclosure activity is based on the total number of properties that receive foreclosure filings – default notice, foreclosure auction notice or bank repossession – each month. Interest rate is based on the average 30-year fixed rate from Freddie Mac Primary Mortgage Market Survey.

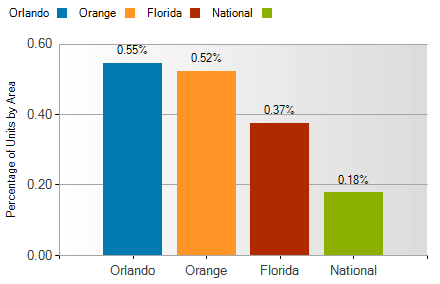

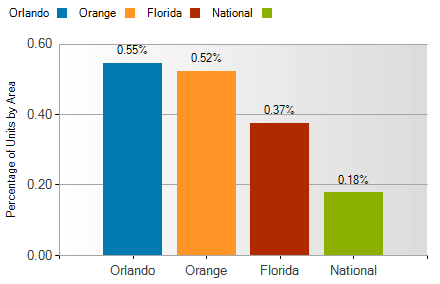

Orlando FL Foreclosure Geographical Comparison

Orlando FL foreclosures were 0.37% above national statistics, 0.18% above Florida figures and 0.03% above Orange County numbers in October.

Orlando FL Foreclosure Activity by Month

Read the rest of this entry »

Tags: foreclosure, homes for sale, orlando avenue top team, orlando fl, real estate, Teri Isner

Posted in General Real Estate, Orlando | No Comments »