March 25th, 2016 by tisner

![The Mortgage Process: What You Need To Know [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/03/Mortgage-Process-KCM.jpg)

Some Highlights:

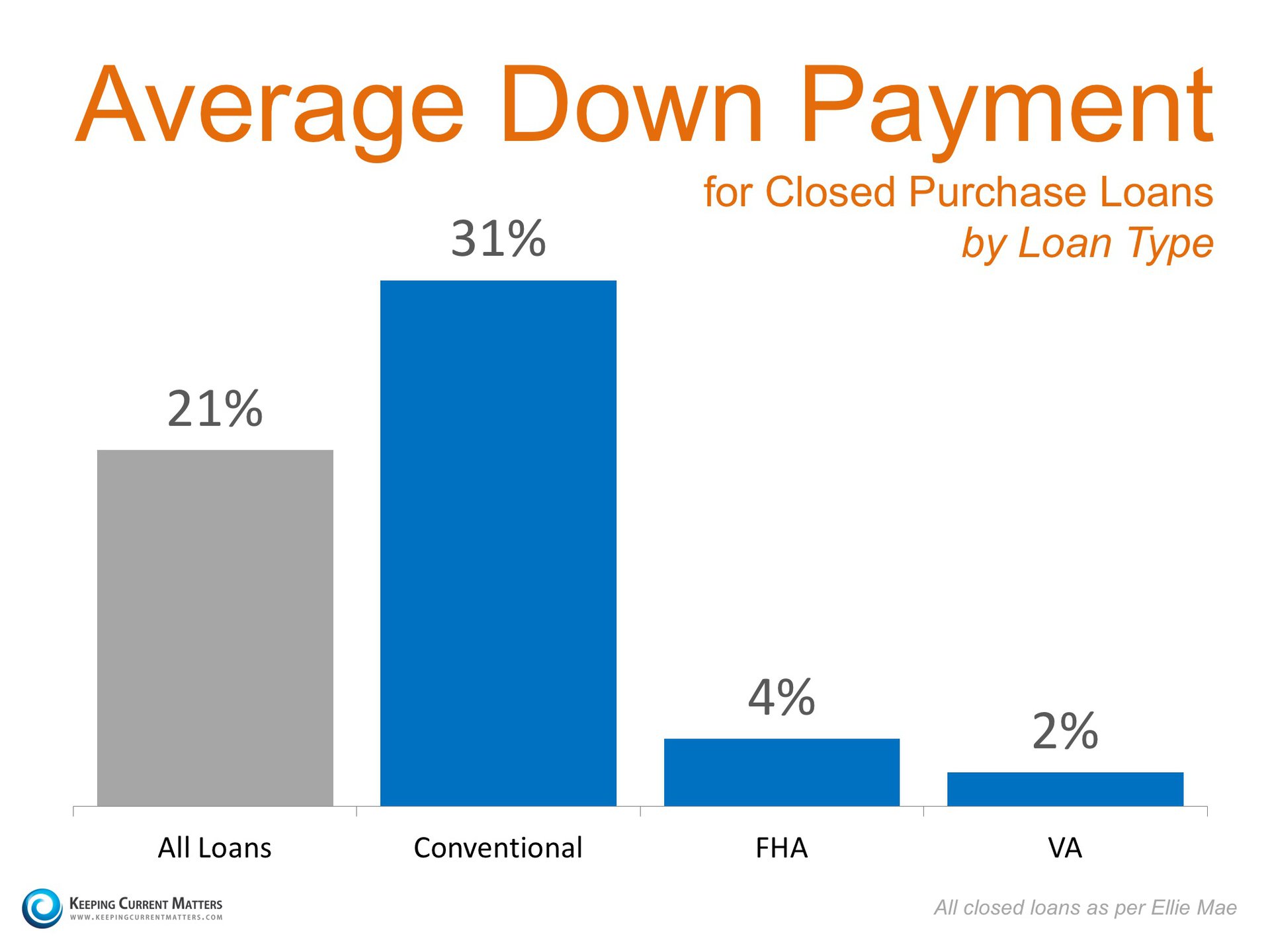

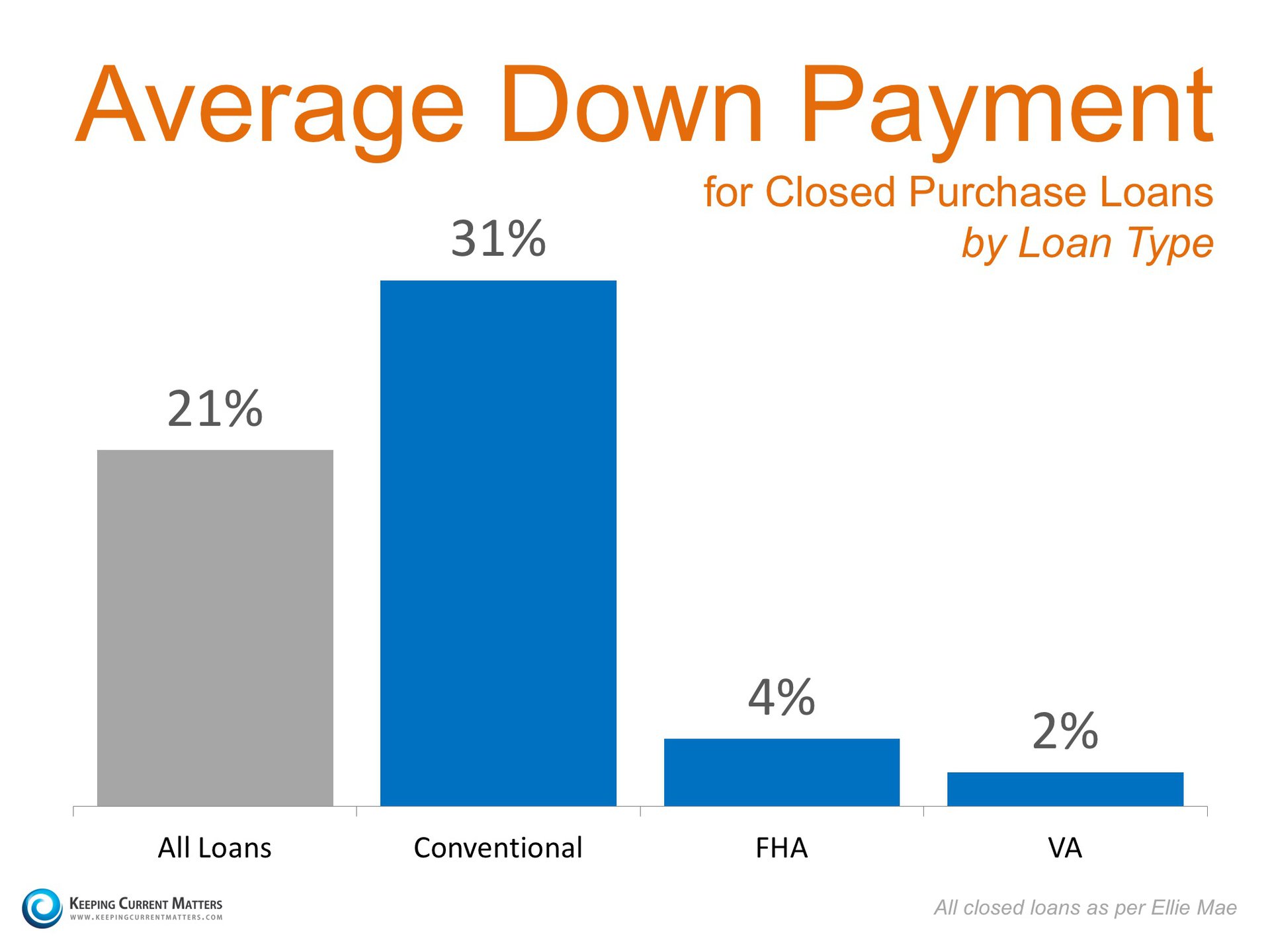

- Many buyers are purchasing a home with a down payment as little as 3%.

- You may already qualify for a loan, even if you don’t have perfect credit.

- Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: getting home loan, home buying tips, mortgage process, orlando avenue top team, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

March 10th, 2016 by tisner

Owning a home of your very own is exciting and is the American dream. You should know however that when applying for a mortgage you need to be as honest as possible so that your dreams are not crushed at the last minute. Below are a few tips on what not to say when you are applying for a home mortgage. You may think that a little white lie won’t get you into trouble when applying for a home mortgage but what most people don’t realize is that you will likely get caught in that lie and may end up not getting approved after all. Also the penalties for such lies can be quite severe such as a 30 year prison sentence and a million dollar fine.

- If you don’t plan to live in the home in which you are getting a mortgage but rather you plan to rent the property out do NOT apply for a mortgage as your primary residence. Default rates are higher on investment properties than they are on primary residences. Down payments are larger on investment properties as well. These are some of the reasons why folks try to lie about using the mortgage as their primary residence.

- Lying about how much money you make to get a home mortgage is also a no-no. If you try to lie about your income for the purposes of getting a better home mortgage you are very likely to get caught because your lender is going to verify your income by looking at your w-2’s as well as your tax returns.

- If you don’t have enough money for the down payment on your new home, you CAN borrow it from a family member or friend but if you do this you need to be sure to have the paperwork that supports the fact that it is a gift that you don’t have to repay otherwise it is considered a loan and the mortgage company will need to know about it. This little white lie may seem harmless but it isn’t and it can get you into trouble with your mortgage lender.

Basically, tell the truth about any and everything your mortgage lender asks you. If you want to have part of the American dream by owning your own home, don’t destroy the dream by lying. Once you get your mortgage and you move into your new home you will be glad you did everything the right way and that you don’t have to worry about anything coming back on you in the future.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: applying for a mortgage, home buying tips, how to apply for mortgage, orlando avenue top team, orlando fl real estate, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

January 26th, 2016 by tisner

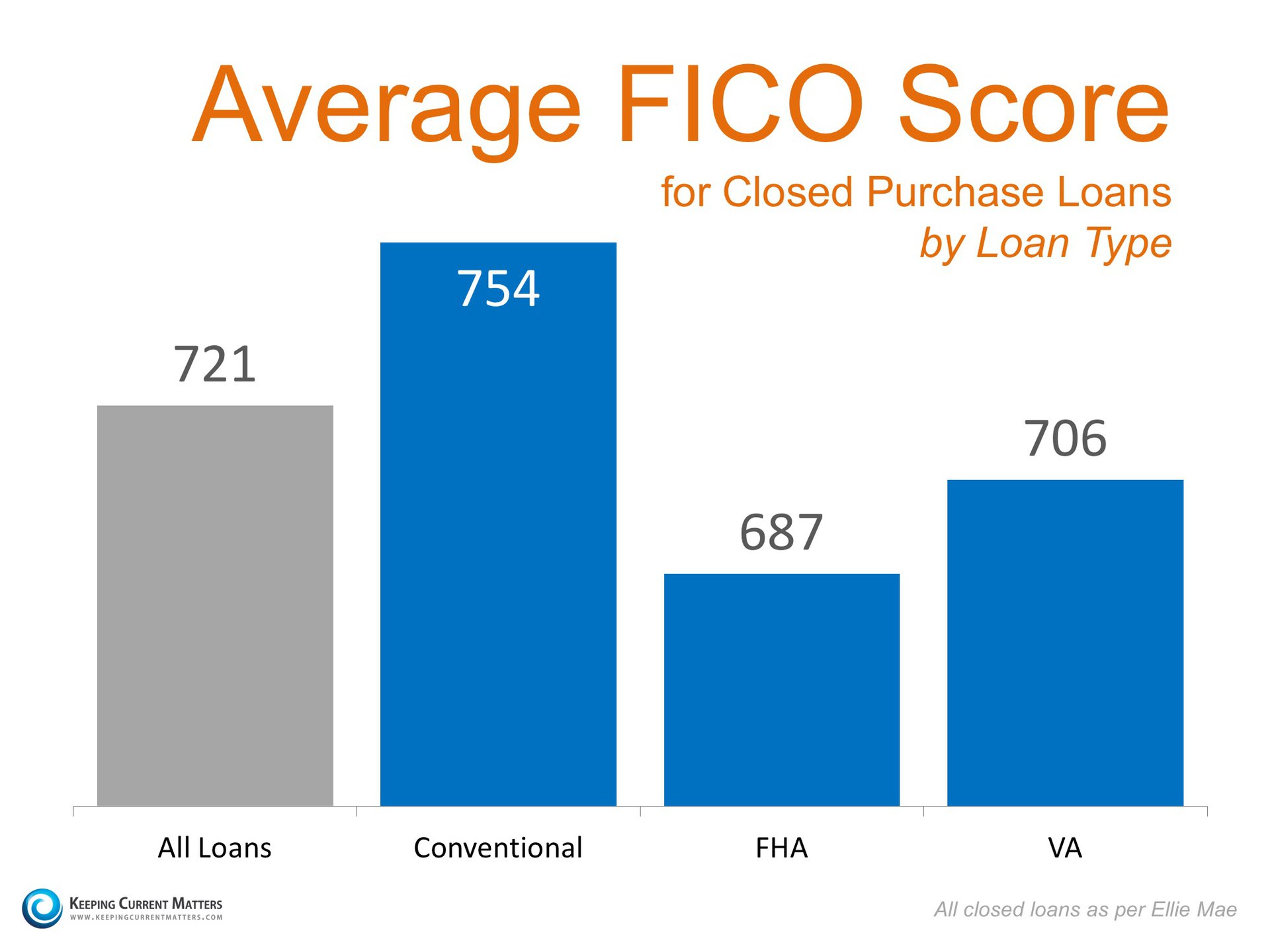

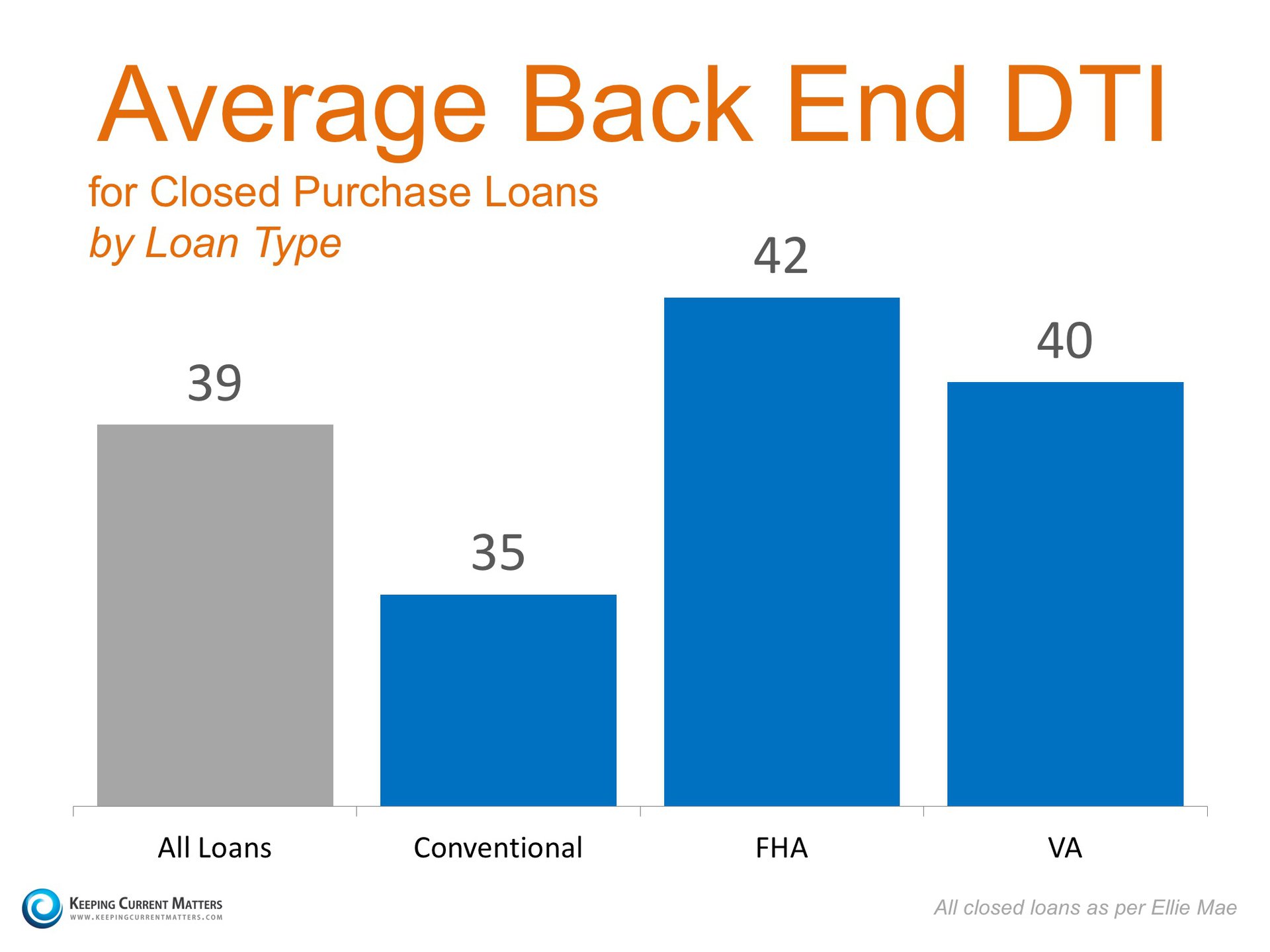

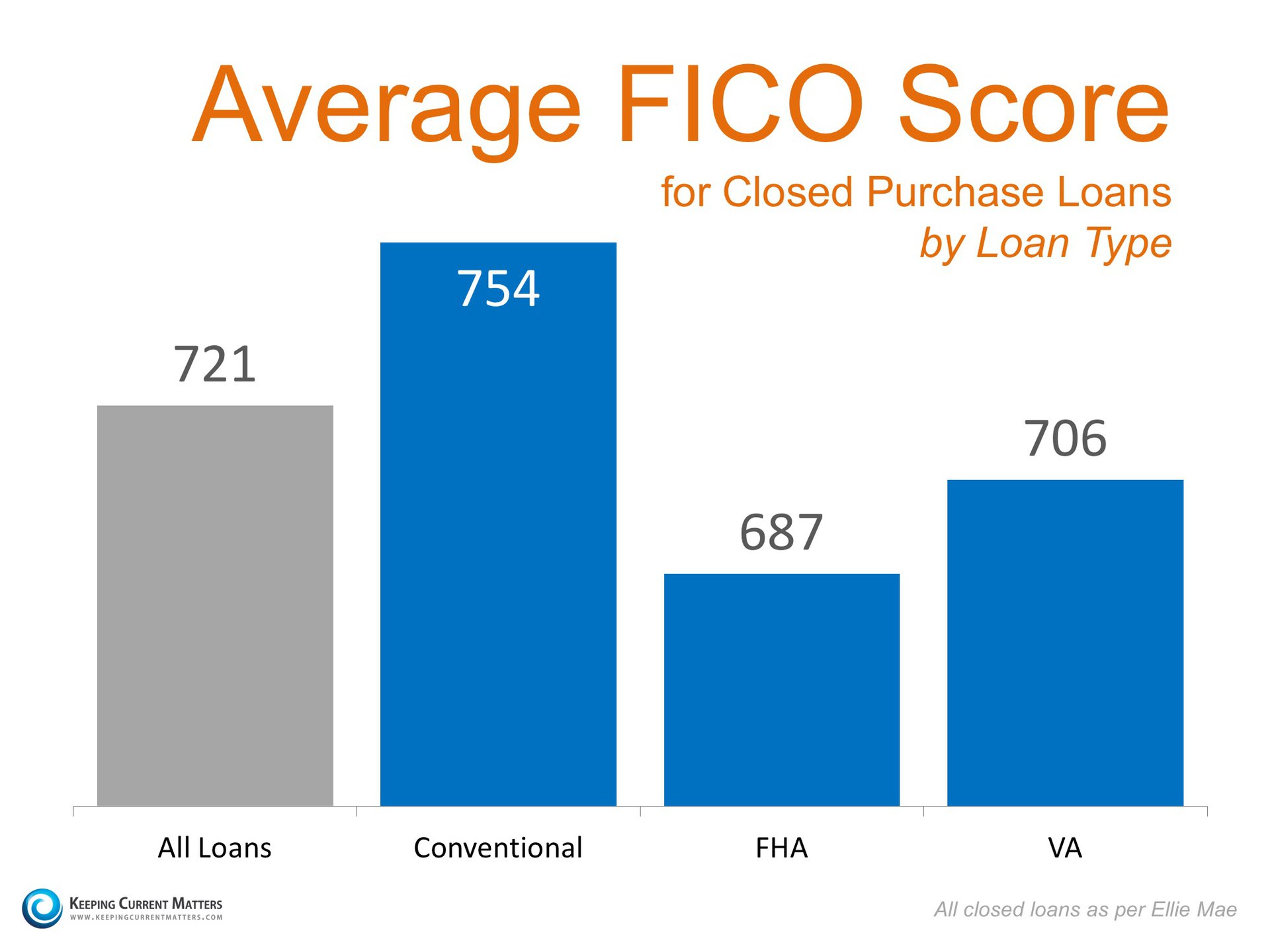

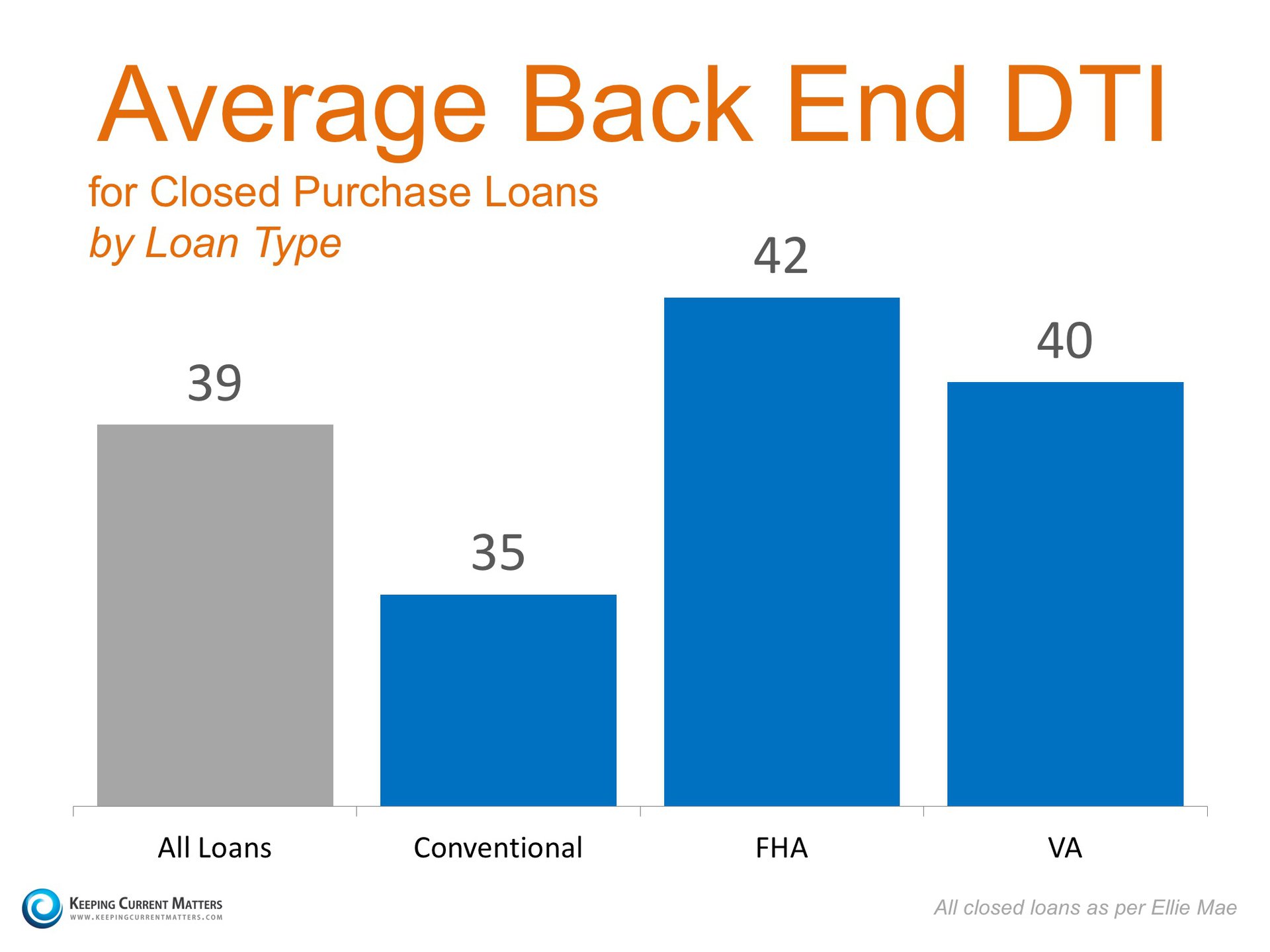

Fannie Mae recently released their “What do consumers know about the Mortgage Qualification Criteria?” Study. The study revealed that Americans are misinformed about what is required to qualify for a mortgage when purchasing a home. Here are three takeaways:

- 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary

- 86% of Americans either don’t know (59%) or are misinformed (25%) about what an appropriate Back End Debt-to-Income (DTI) ratios is

- 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required

To help correct these misunderstandings, let’s take a look at the latest Ellie Mae Origination Insight Report, which focuses on recently closed (approved) loans.

FICO SCORES

BACK END DTI

DOWN PAYMENTS

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will definitely make the mortgage process easier. Your dream home may already be within your reach.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: getting home loan, home buying tips, need to qualify, orlando avenue top team, orlando real estate, qualifying for mortgage, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

December 23rd, 2015 by tisner

We all have New Year’s resolutions each year. Why not make 2016 a great one by deciding once and for all to get your finances in order. There are several ways that you can make a big step to improving your finances for this coming year that are not that difficult to do.

- One of the first things you should do in order to get a hold of your finances is to write down everything you spend for at least a month. This way you will be able to clearly see where your money is going and where it is not. You may find that you are a bit surprised by exactly how much money you waste on a daily basis buying things that you can definitely do without.

- Another easy step to taking a hold of your financial situation this coming year is to start paying off your credit cards. It is a good idea to start with the smallest amounts owed on credit and pay that amount off first, then move to the larger amounts owed and whittle them down as well. Once you pay off your credit cards do your best to do without them if you possibly can. Living on a cash only basis is a great way to take charge of your finances. If you don’t have it, you don’t spend it…it can be as simple as that!

- This is a bit old school, but clipping coupons is a great way to help ease financial strains that you may have gotten yourself into. There are several ways to coupon and many times you can get products completely free of charge if you get good enough at couponing. Make a stockpile of things that you use on a regular basis such as toilet paper and toothpaste and other items you can get very cheap or free.

- If you can, it is a good idea to save up an emergency fund for things that may go wrong now and again such as car repairs and the like. A good amount to strive to save up is around $1,000. This will be a big help when you find yourself in need.

This should be a good start to getting you thinking about your finances and how to take control of them before they take control of you. This time of year it can be hard to think about finances due to the holidays and all that they include but it is well worth it if you do so that you can start out the New Year in the right direction.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: finances, orlando avenue top team, Teri Isner

Posted in Financing | No Comments »

November 20th, 2015 by tisner

We have all been there before, getting ready to buy a house and then suddenly something of a negative nature pops up on our credit score that poses to keep us out of our dream home forever. There are ways to make sure you DO NOT end up in this sort of predicament however. Hopefully, the following tips for raising your credit score will be beneficial to you so that you can find your new home!

- Pay credit card bills before the statement date. Many times folks wait until the due date to pay a bill but if you are willing and able to pay them before the statement date, your credit score is likely to improve.

- If you can afford to make multiple payments on your credit balance throughout the month, this will also show favorably on your credit score. Check with your credit card company to make sure you are allowed to do this before beginning because some do not allow it.

- If you only have a couple bad marks on your credit, you can ask for a “good will deletion” . Of course if you are late over and over again you will not be able to reap this reward but if you can show that you otherwise have paid your bills on time you may be able to get those couple nasty marks off your credit and therefore raise your score!

- If one of your accounts has recently gone into collections you may be able to pay it off and have it removed from your credit report as a result. Be sure to get any type of promise to delete in writing so that you can be sure it will be taken off once you pay.

Credit issues can be hard to deal with especially if you are looking to purchase a new home in the near future, but take it from someone who knows….it CAN be done and you CAN have the house of your dreams maybe sooner than you had imagined! Keep working at it and you will succeed and come out the other side ready to move forward into your future!

Courtesy of Orlando FL Realtor Teri Isner!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: home buying tips, know your credit score, orlando avenue top team, raising credit score, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

October 20th, 2015 by tisner

As rates are inching up but still very affordable, buyers should remember that there is an alternative to a fixed rate mortgage that can provide the lowest cost of housing for the homeowners who understand the parameters.

A $300,000 fixed-rate mortgage at 4% has a principal and interest payment of $1,432.25 per month for the entire 30 year term. A 5/1 adjustable mortgage at 3% has a $167.43 lower payment for the first five years and then, can adjust, up or down, based on a predetermined index.

Another interesting fact is that the unpaid balance on the ARM at the end of the first five years is $4,624 lower than the fixed-rate mortgage. The total savings in the first five years on the ARM is $14,669.00.

Adjustable rate mortgages are not the right choice for everyone but buyers should at least consider the options based on their individual situation. It could be an obvious choice for a buyer who is only going to be in the home for five years or less.

Use the ARM Comparison worksheet to see what possible savings you could have based on your actual numbers. A trusted mortgage professional can help you to understand the advantages and disadvantages based on your situation. You need the facts to make the best decision.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: finding best mortgage, home loan, mortgage, orlando avenue top team, Orlando Real Estate Expert Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

September 17th, 2015 by tisner

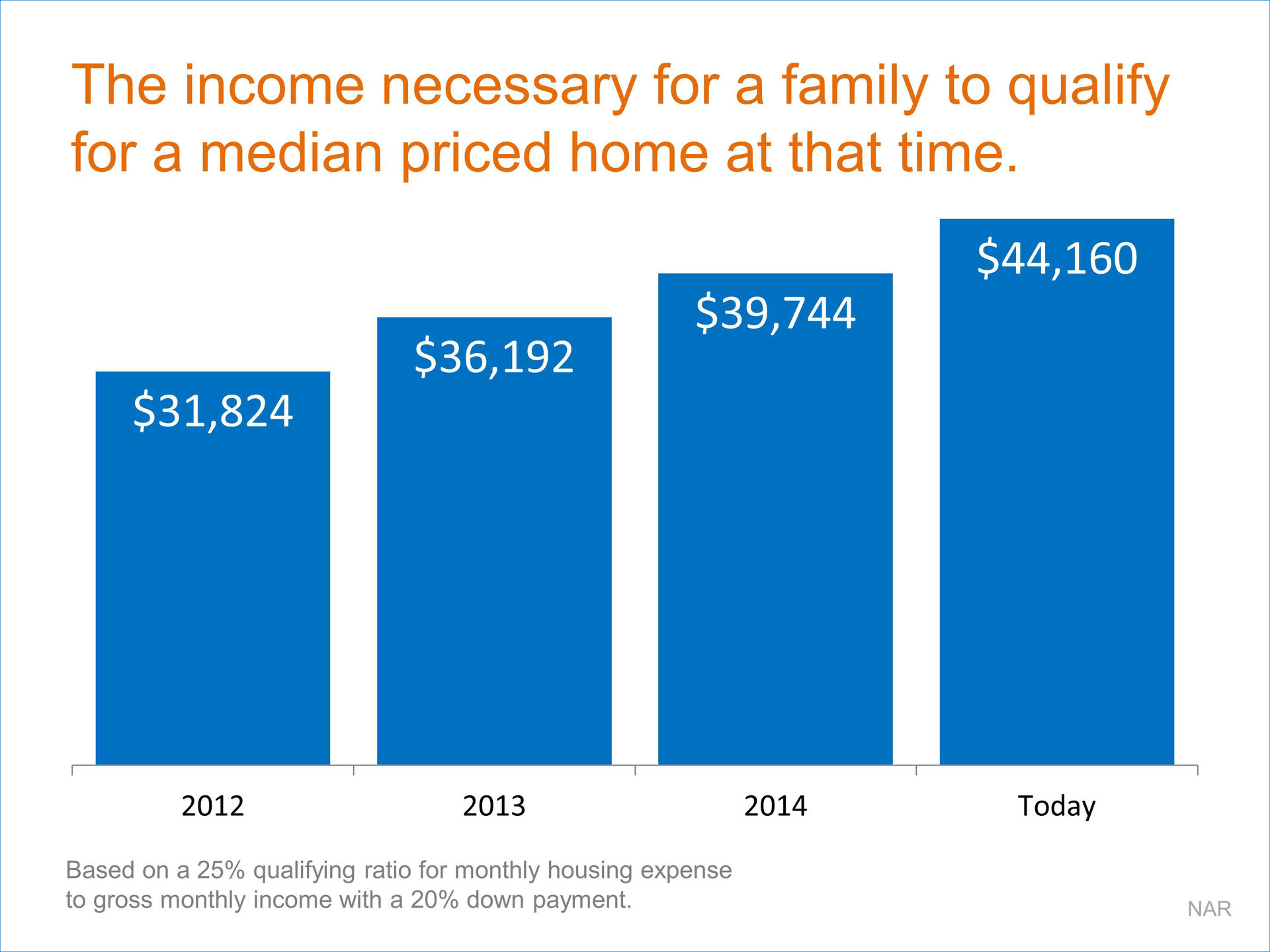

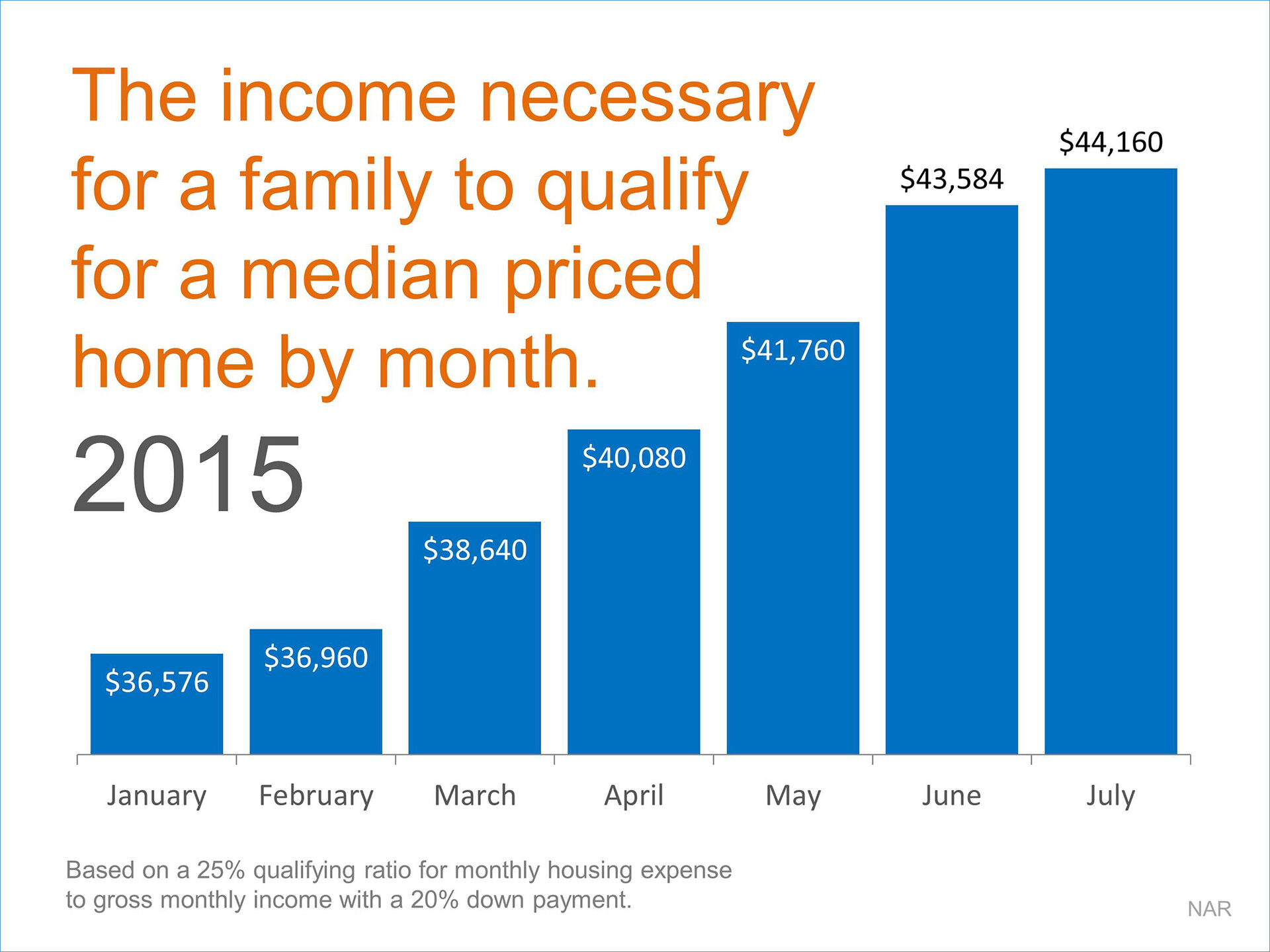

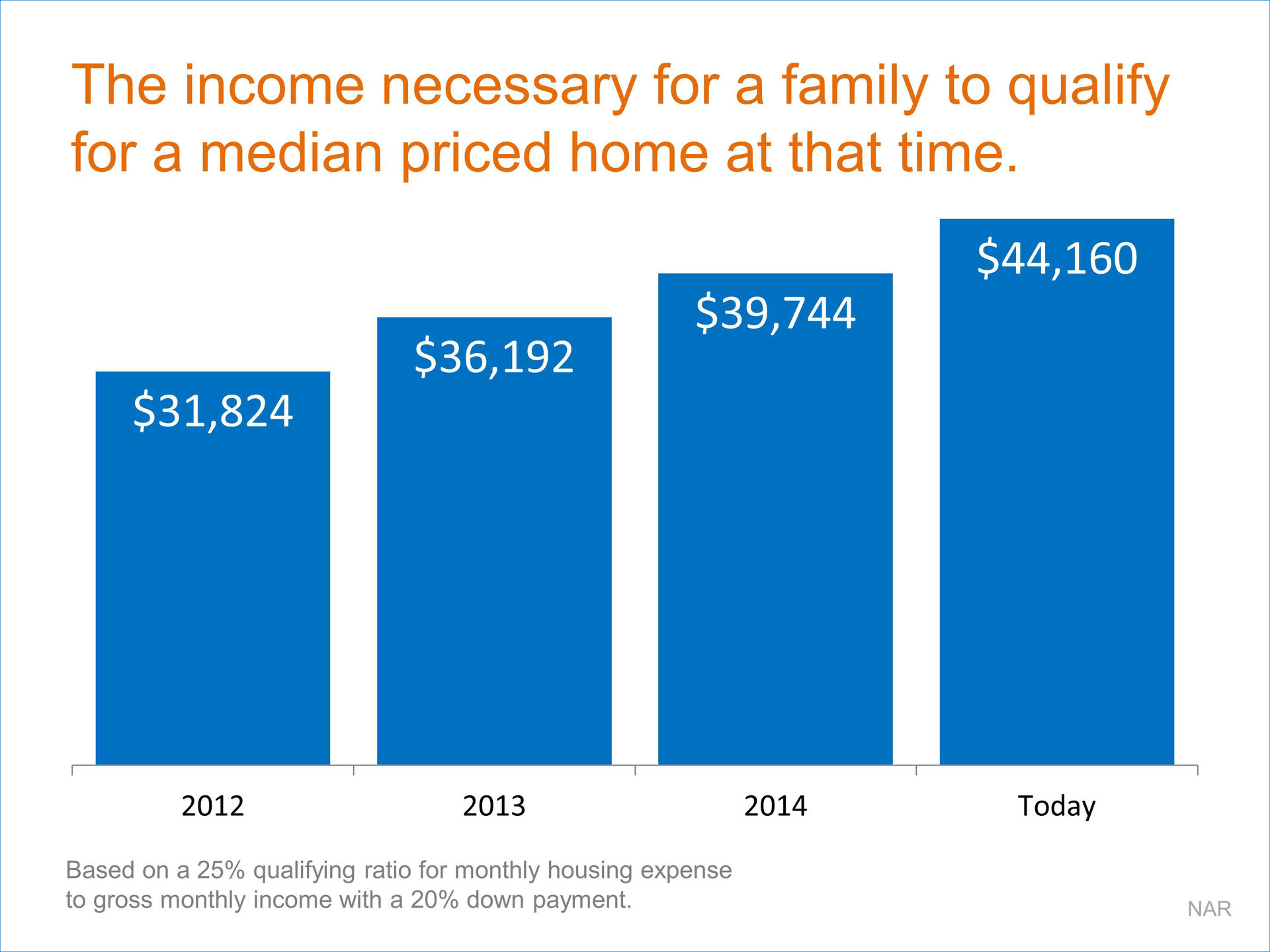

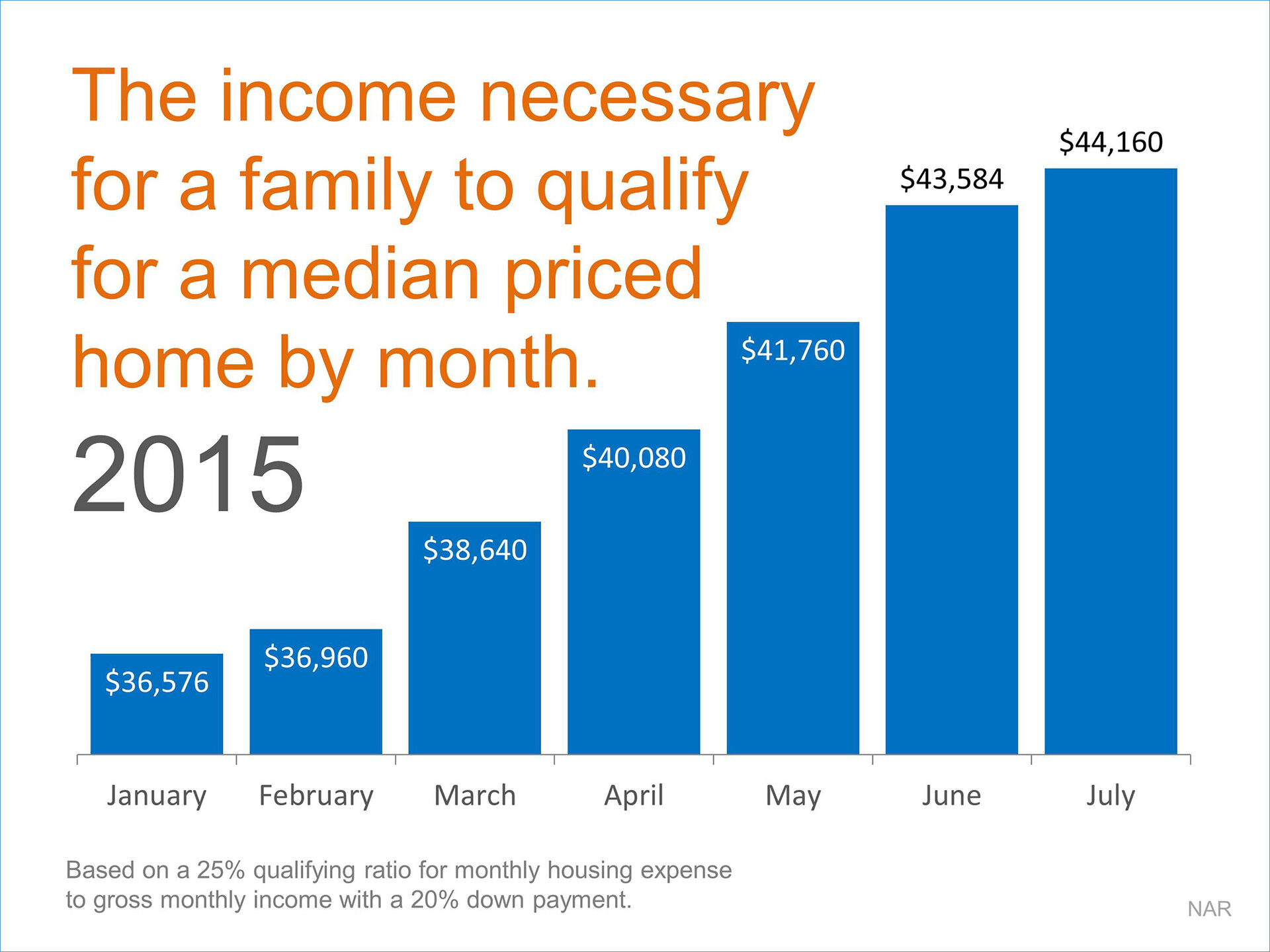

The National Association of Realtors (NAR) recently released their July edition of the Housing Affordability Index. The index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data. NAR looks at the monthly mortgage payment (principal & interest) which is determined by the median sales price and mortgage interest rate at the time. With that information, NAR calculates the income necessary for a family to qualify for that mortgage amount (based on a 25% qualifying ratio for monthly housing expense to gross monthly income and a 20% down payment).

Here is a graph of the income needed to buy a median priced home in the country over the last several years:

And the income requirement has accelerated even more dramatically this year as prices have risen:

Bottom Line

Some buyers may be waiting to save up a larger down payment. Others may be waiting for a promotion and more money. Just realize that, while you are waiting, the requirements are also changing.

Tags: cost of waiting to buy, home buying tips, Teri Isner, teri isner orlando avenue top team

Posted in About Orlando, Financing, General Real Estate, Orlando Buyers | No Comments »

September 11th, 2015 by tisner

Interest rates remain extremely low making this a great time to think about refinancing you home. Here are a few tips for refinancing that will help you in making an informed decision.

- If you have an FHA loan you need to get rid of the mortgage insurance as quickly as you possibly can. Mortgage insurance on FHA loans can add up over the years more than you realize. You will need to refinance your FHA loan into a different mortgage in order to get rid of the mortgage insurance if your loan is for 30 years and you put less than 10% down.

- Be careful not to refinance too often just because interest rates have gotten lower. It is worth it to refinance for just half a percent these days but don’t keep going after lower and lower rates. It is best not to refinance more than two to three times during the life of your loan.

- If you do decide to refinance your home loan, it is best to refinance for a shorter number of years. Refinancing a 30 year loan to another 30 year loan is essentially adding another 5 years to your payoff date. If you refinance try to refinance for 15 years if you can afford to do so.

- If you are planning to sell your home anytime soon it is not a good idea to refinance because you are going to have to pay closing costs and therefore will be losing money in the long run. Be sure to take into consideration your long term goals when you consider refinancing.

- Shop around for your new loan. Just because you have had a good rapport with your current mortgage company doesn’t mean you have to refinance with them. Do your part by shopping around for the best rate and take the one that saves you the most money.

Refinancing your home can be a great way to get ahead in life and to save some money along the way. If you want to refinance I would suggest that you get online to check out what rates are being offered these days and to get the ball rolling!

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: orlando avenue top team, refinancing tips, refinancing your home, Teri Isner, tips for reninancing

Posted in Financing, General Real Estate | No Comments »

July 30th, 2015 by tisner

As a follow-up to a recent blog post,Your Credit and Your Home Purchase, I want to share a tip from a credit restoration company I know…

“As Shakespeare almost put it, To Pay Or Not To Pay, that is the question:

When it comes to your credit scores, paying the right account or the wrong account can make a massive difference in your credit scores. Let’s focus on what not to pay. One would assume when paying off bad debts on your credit report, the credit scores would always increase. However “one” is not always correct. Paying off items like your utility collection, or your cell phone collection will most likely decrease your scores. This is despite the popular belief that having a $0 balance on your collection accounts must be better than owing money. Balances on collections are irrelevant, for example you could have a one million dollar medical collection or a one dollar medical collection and if everything else is the same the scores would also be the same. The reason why your scores generally decrease when a payment is made is because by making a payment you reactivate the account causing it to report as new again. This is shown as the ‘DLA’ on a credit report. This ‘DLA’ or ‘Date of Last Activity’ represents the weight of the account AND the seven year statute until the item will fall off naturally (which is a whole other problem, but we will save that for another day).

When it comes to your credit scores, paying the right account or the wrong account can make a massive difference in your credit scores. Let’s focus on what not to pay. One would assume when paying off bad debts on your credit report, the credit scores would always increase. However “one” is not always correct. Paying off items like your utility collection, or your cell phone collection will most likely decrease your scores. This is despite the popular belief that having a $0 balance on your collection accounts must be better than owing money. Balances on collections are irrelevant, for example you could have a one million dollar medical collection or a one dollar medical collection and if everything else is the same the scores would also be the same. The reason why your scores generally decrease when a payment is made is because by making a payment you reactivate the account causing it to report as new again. This is shown as the ‘DLA’ on a credit report. This ‘DLA’ or ‘Date of Last Activity’ represents the weight of the account AND the seven year statute until the item will fall off naturally (which is a whole other problem, but we will save that for another day).

The reasoning behind this madness is that the algorithms that calculate scores cannot discriminate against wealthier/poorer individuals. So the fact that a wealthier person has the ability to pay off a certain dollar amount more easily than a poorer person would be discriminatory on algorithm calculation.”

Confused? Contact us and we’ll put you in touch with a reliable lender who can answer your questions.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: credit score, home buying tips, orlando avenue top team, orlando real estate, paying off debt, Teri Isner

Posted in Financing, Orlando Buyers | No Comments »

July 22nd, 2015 by tisner

When buying a home it is prudent to know about your credit score. According to a recent survey by Experian, many of those in the market for a home are already aware of the importance of their credit score. However, only half of recent buyers said they checked their credit when they first considered purchasing a home.

- 67% of buyers are NOT pre-approved

- 45% of buyers delay their purchase (ultimately) to improve their credit

That is almost HALF of buyers who delay the purchase based on information they should have known prior to shopping for a home.

This survey underscores how important the pre-approval loan process is. Even if just to give buyersan idea of what their credit report contains, what their rate and payment would be and how much they can qualify to buy. Too often, there are situations where people cannot qualify once under contract and it would have been quickly uncovered during a pre-approval. This represents wasted time for the realtor, buyer, seller and all involved.

Lesson learned? Pay attention to your credit year-round, and understand that what you do today impacts how your credit works for you in critical purchase moments like home buying.

Information provided by Orlando Realtor Teri Isner.

Access Teri’s one-stop Orlando FL home search website.

Teri Isner is the team leader of Orlando Avenue Top Team and has been a Realtor for over 24 years. Teri has distinguished herself as a leader in the Orlando FL real estate market. Teri assists buyers looking for Orlando FL real estate for sale and aggressively markets Orlando FL homes for sale.

You deserve professional real estate service! You obtain the best results with Teri Isner plus you benefit from her marketing skills, experience and ability to network with other REALTORS®. Your job gets done pleasantly and efficiently. You are able to make important decisions easily with fast, accurate information from Teri. The Orlando Avenue Top Team handles the details and follow-up that are important to the success of your transaction.

Get Orlando Daily News delivered to your inbox! Subscribe here!

Tags: credit score, know your credit score, loan pre-apporval, orlando avenue top team, orlando realtor, Teri Isner

Posted in Financing, General Real Estate, Orlando Buyers | No Comments »

![The Mortgage Process: What You Need To Know [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/03/Mortgage-Process-KCM.jpg)